Out of Pocket Costs: 3 Pain Points to Address with Your Clients

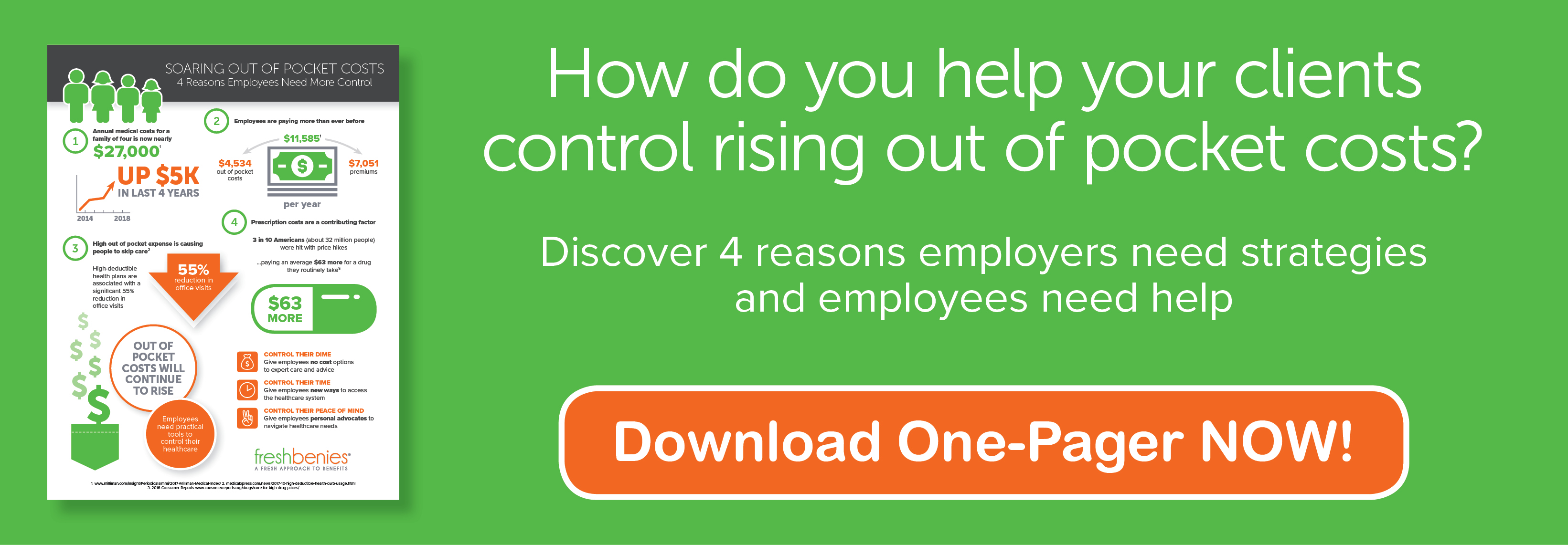

I KNOW you’re implementing strategic ideas to contain skyrocketing out of pocket costs. While you continuously strive to care for your clients, the realities of healthcare in our country make it more challenging each year. As I’m sure you’re VERY aware, unfortunately employees and their families are paying for more than ever before: click here to get our infographic with current stats.

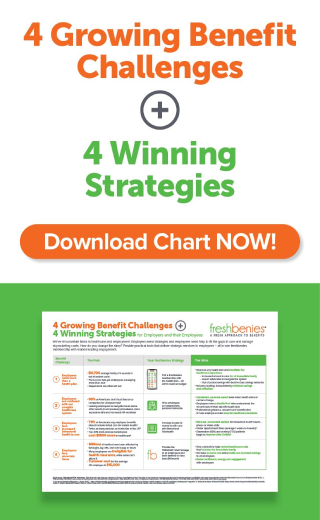

I’m highlighting three problems associated with rising out of pocket costs that top advisors must address with their clients.

1. Shrinking coverage and higher costs go hand in hand

Employers are paying higher prices for plans with shrinking networks and narrowed formularies. These plans force families to shoulder 43% of medical cost – now averaging over $11,500, with $4500 being out of pocket spend. This constitutes an increase for families of more than $1,000 every year for the last four years.

How do smaller networks and the rising cost of care play out? Consider this stat: one-third of patients are referred to specialists each year and 50% of those referrals are out-of-network. It’s easy to see how the pain points of rising premiums, smaller networks and high out of pocket costs quickly collide for employees.

2. Foregoing care is costly for everyone

High Deductible Health Plans are associated with a 55% reduction in office visits. On the front end, HSA’s have consistently remained a strong option for lower premiums and tax incentives mixed with the idea it would empower employees to be better consumers. However, on the back end, we’re seeing that without providing practical transparency tools, education and direction on the cavernous healthcare space, people are tending to just avoid it altogether – which means they’re skipping both appropriate and inappropriate care.

This recent article highlights the irony that while the US spends the most on healthcare, we are not among the healthiest populations. Too often, Americans are forced to decide whether they can afford to use their medical plans. From missing an early diagnosis for a major medical issue to foregoing care for a respiratory issue that later lands an employee in the ER, these decisions are costly for that family and the employer-provided medical plan. Further, people are also skimping on medications due to cost, which brings me to my next point.

3. Rx is a BIG contributing factor

Three in ten Americans (about 32 million people) have been hit with a $63 price hike on drugs they routinely take. Most consumers feel they have no options in this situation. Our recent infographic shows this pharmacy cost driver cannot be ignored. A few things to consider.

- Increasing use of specialty drugs will prove the fastest growing cost component in any medical plan (and contribute to electing a self-funded design plan for many groups). Click here to see 3 trends that show your clients need another prescription strategy outside of the health plan.

- Removing medications from medical plans doesn’t remove the need for that prescription. Click here to learn why every employer should have another cost-saving option.

- Empowering employees with tools and education can uncover more cost-effective options. Read here for a story about how our Chief Strategy Officer saved over $6,000 a year on her prescription.

Higher overall medical costs for employers and employees coupled with soaring out of pocket spend make it harder to care for your clients and their families. Use these pain points as stepping stones to talk to your clients about new strategies and solutions for containing costs and increasing access to care. They rely on your knowledge and expertise, and I know YOU use that power to guide them toward smart decisions!

Now it’s your turn! Have you noticed these trends impacting your clients? How have you responded? Comment below or email us at brokers@freshbenies.com.