SURVIVING OBAMACARE SIMPLY: HOW TO CHOOSE INSURANCE PLANS

You know that overwhelming feeling you get when standing in the shampoo aisle looking at all the choices before you? Conditioning, strengthening, softening, volumizing, clarifying, for fine hair, for colored hair, for oily hair, for limp hair, for dandruff, for split ends, for bald people…ARRRGGHHH!

Now, take that same feeling and apply it to the 50+ health insurance plan choices you’re about to be presented with (if you’re buying it on your own).

Shampoo costs a few dollars, so if you make a mistake you can give it away and try something else. Health insurance might cost about $400 per month (that’s $4,800 a year) with farther reaching affects that could cost thousands, so you really want to get it right the first time!

Answering the following questions will help guide you to a health insurance plan that fits your needs!

Who am I buying insurance for?

Just you - It’s simple. When estimating your premium, deductibles, out-of-pocket maximum, etc. in the next section, it’ll just be for you as an individual.

You & family – When estimating for a family, you’ll want to consider the family level of premium, deductibles, out-of-pocket maximum, etc.

How much can I spend?

To figure this out, I suggest you first calculate 2 numbers for yourself or your family.

A. What’s the maximum amount you feel comfortable spending on healthcare in a year?

The answer to this question is dependent on your comfort level with risk. It might be a healthy year where your healthcare expenditures are low. But, it could be a “train wreck” year where your family experiences sickness, accidents, cancer (God forbid!), etc. and your healthcare expenditures are high.

Many people look only at the plan’s Deductible to see how much they’ll be paying out of pocket. These days, a Deductible is just the point at which you and the insurance company start sharing the health expenses. The more important number is called the Out-Of-Pocket Max. As the name implies, this is the most you’ll pay in a year. Once you hit that Max number, you’re insurance will take over in and begin paying all your healthcare expenses.

So the question is: if THIS is the “train wreck” year, what’s the maximum you could pay out of your pocket on healthcare costs (not counting your monthly insurance premium)? $0 (I have nothing in savings to go toward additional healthcare costs), $2,000, $10,000? Whatever the number is, write it here: $_______.

B. How much do you expect to spend on healthcare in the next year?

For this step, ignore the amount you spend on insurance premiums. Just consider your actual healthcare expenses: how many times did you visit the doctor and what was the cost of the visits? How about the urgent care center? How many prescriptions did you have and what was the cost? How many times did your family have lab tests and what was the costs? What else did you spend money on for healthcare? It’s helpful to look back a couple years to get a good idea of your average spending and visits. If you don’t know this, think back and start tracking it immediately because that number will help you determine the best insurance plan. Also, consider if you have any upcoming planned health expenses (surgeries, procedures, that bum knee that needs to be fixed, etc.). Write your best estimate on the coming year’s costs here: $________.

How to I determine the best plan?

Now that you know the 2 numbers, you can zero in on your best health insurance plan. First, start by sorting all the plans by monthly premium, then follow these steps....

1. Eliminate plans with high Maximum Out Of Pocket Costs: Eliminate all those where the Out Of Pocket Max is higher than the number you put in A above. Start by looking at the least expensive premium plans. Find two plans to compare (note: be sure your favorite family doctor(s) is in the network).

2. Review monthly Premiums: What’s the difference in annual premium between the plans?

3. Determine "Healthy Year” costs: Look at each of these plans and calculate how much you would pay out of pocket if you had a normal year of healthcare costs. Use the info you compiled from B above (i.e. what will you pay in prescription co-pays, office visit co-pays, urgent care center costs, lab tests, etc.?) and compare how these expenses are covered by the 2 insurance plans you're considering.

Here's an example: Plan X has a $50 co-pay for a doctor office visit but Plan Y is 100% out of pocket - a typical doctor visit is about $150. If you figured your family has about 10 doctor visits each year, you'll be paying out of pocket $500 under Plan X and $1500 under Plan Y. The same goes for prescriptions. If your family has 5 monthly prescriptions and Plan X has a $20 co-pay, but Plan Y has a $10 co-pay, you'll pay $1200 for the year under Plan X and $600 under Plan Y.

This is why it's important to know your family's healthcare cost history - so you can apply it to the plans you're choosing.

Once you're done coming up with a ballpark number for each plan, add 12 months of insurance premium to it and write it here: $_______.

4. Determine “Train Wreck Year” costs: Look at each of these plans - this time add the Out-Of-Pocket Max for each plan to the cost of 12 months of insurance premium and write it here: $_______.

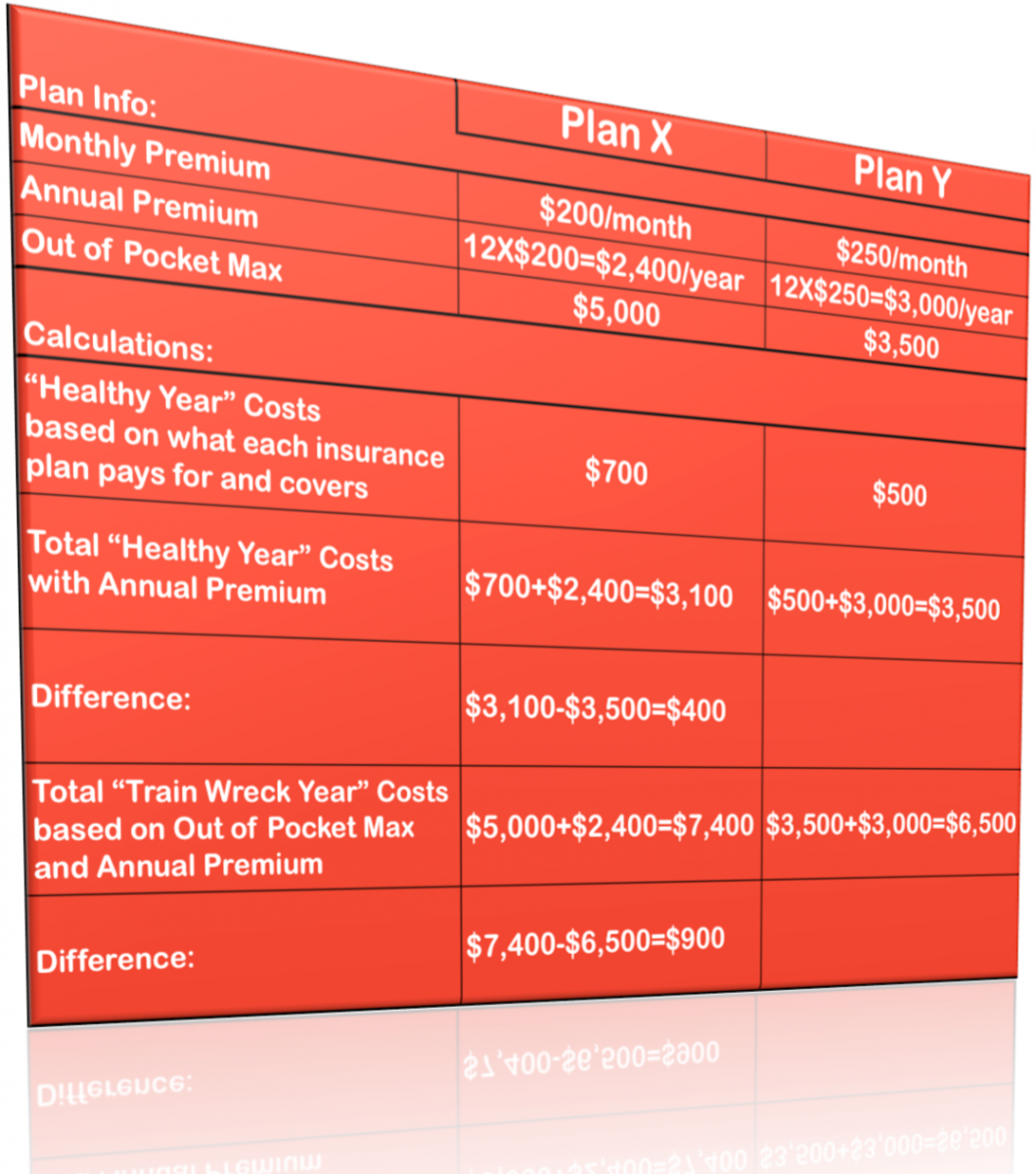

5. Figure the differences between plans: See the example chart below and use it as a guide with your own plans and costs. In the end, you want to find the difference in cost between the two plans in a “Healthy Year” in #3 and the difference in cost between the two plans in a “Train Wreck Year” in #4.

This is easier to see with real numbers, so see the scenario below.

How do I make a final choice?

By now, the right choice should become clearer. Let’s say you choose Plan X due to the lower cost in a healthy year and you don't expect many "Train Wreck Years." At this point look at other considerations: Does Plan X cover your monthly prescription drug(s)? Is your favorite hospital in the network for Plan X? If you're still leaning toward that plan, ask yourself: How often will I have a “Train Wreck Year?” If not very often, look at how much premium you will have saved over those years with Plan X. It’s probably more than enough to pay for that one bad year of higher out-of-pocket.

Now it's your turn! What criteria do you use to choose a health insurance plan? Will you be going to your State Exchange to find a plan? Do you use an insurance agent to help wade through it all?