SURVIVING OBAMACARE SIMPLY: “IN-NETWORK” & “OUT-OF-NETWORK”

When mingling at dinner parties, do you get into random conversations with people about their medical situation? As a side effect of owning a company in the healthcare space, I do (it’s glamorous, I know)! This month, I’ve had two separate conversations with people who’ve told me stories of $100,000+ in medical bills for an appendectomy gone wrong and a whopping $1.5 million medical bill for a bowel obstruction (I hoped they cleared out a bar of gold! Just sayin’!). Others tell me stories of being charged an “out-of-network” price for a procedure they had done while unconscious in an emergency room!

What’s an “out-of-network” price, you ask? Let’s go back a little to understand how medical prices are set in the United States (click here for more on the topic)…

Unlike most industries, Government spending has a HUGE affect on where healthcare pricing starts. In the US, EVERY medical procedure or service available (and there are thousands of them) starts with the Medicare price as a baseline. In other words, if someone on Medicare had the procedure, the baseline price is what Medicare would pay the provider.

fb2.0_medical_bill_saver_blog_ad.jpg

All medical procedures for the rest of us in this country are then priced relative to Medicare pricing. Insurance companies take the Medicare baseline price and work with every local provider (docs, hospitals, imaging centers, etc.) to negotiate what they will pay for each of these procedures or services. Each procedure is given a code (like a SKU) and today there are 13,000 different medical procedure codes. Can you imagine the tracking spreadsheet for prices of thousands of procedures across thousands of providers? YIKES! There are entire careers built on dealing with medical pricing and billing.

If your insurance company has negotiated a price with a provider, that provider is considered “in the network” for your insurance company. This is why you almost always get a better price when you go to a provider who is “in your network.” If you go to a provider who is “out-of-network,” you’re probably going to pay much more – they can charge you any amount and bill you personally for what your insurance company doesn’t cover.

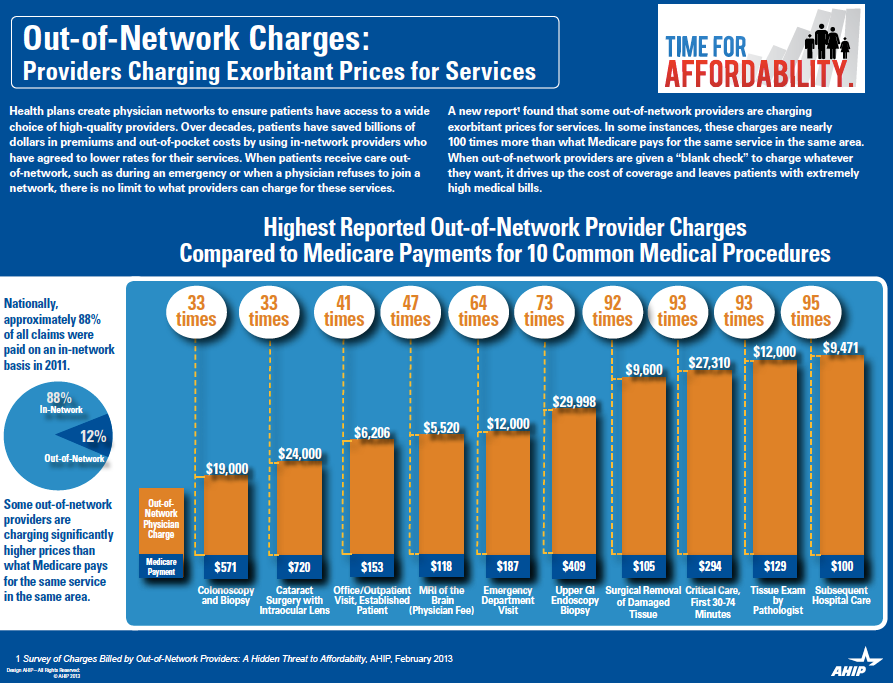

The AHIP chart below gives you a good idea of just how much. AHIP (America’s Health Insurance Plans) is a national trade association that represents the health insurance industry. They completed a survey of charges billed by out-of-network providers and compiled a chart that “provides a snapshot, state-by-state, of exorbitant charges billed by some out-of-network physicians in the 30 largest states by population. The survey further indicated that health plans and their members routinely receive bills from physicians that are 10 to 20, or sometimes nearly 100 times higher than Medicare would allow. It illustrates the value of provider networks and a pressing problem faced by consumers who want affordable, meaningful access to out-of-network providers.”

“Why is this important?” you ask! Good question! To be clear: almost no one pays the Medicare price. But, an in-network price will be much less expensive and therefore “out of pocket” for you. The next time you need your routine colonoscopy, do you want to pay closer to $571 or $19,000?

Click here for an article about how insurance companies are handling networks - we also share some advice on being a better consumer and using networks to your advantage.

Now it’s your turn to tell us your story. Have you had a surprising medical bill? What did you do?