5.5 Ideas for Your Mid-Year Client Reviews

Are you one of those people who LOVE mid-year reviews with your clients? You like getting to consult without it being a negotiation over every nuance of the medical plan renewal price.

Or do you HATE mid-year reviews? You think you’re supposed to bring new ideas and you don’t know what to say this year. So, you stress about it. Or worse, you just don’t do them.

Whichever scenario fits you, I'm sharing 5.5 ideas I've heard over my time in the employee benefits industry. Perhaps there's something here you can use to focus and prepare for solid mid-year conversations....

1. Start with your Stewardship Report

If you’re one who stresses at this idea - or you’re part of the 2/3 of brokers that don’t do mid-year reviews - let’s start with the basics. You need client meetings that aren’t dominated by selling and negotiating a medical plan. Rather, you’re selling YOU. Simply have a conversation that highlights the significant ways you’ve brought value to your client in the past year.

For a great article on this, click here to check out what Kevin Trokey of Q4intelligence advises, including: “…your clients also need your advice and results in so many other areas: compliance, technology, communication, attraction/retention, employee engagement, the list goes on.”

freshbenies TIP #1! Inside your freshbenies Broker Portal, pull a Utilization Dashboard Report for the most recent 12 months (for newer groups - pull all months available). This becomes one portion of your Stewardship Report and shows you did your homework. Be sure to frame your report with a high-level summary that provides a quick takeaway, such as “Your 308 employees used freshbenies 304 times. So, it cost $35,000 and it saved $150,000.” Then, use the report for more detail. Click here for a case study example of how you can tell the story.

2. Rethink consumerism

One of the questions you should expect in a mid-year review is, “What’s coming down the pike that we should consider?” Most employers want to hear innovative ideas, and they want to know you’re prepared to discuss them.

Leverage the calmer environment of this meeting to help clients consider things they wouldn’t address 3 months prior to their anniversary. Sometimes quoting benchmark data or recent articles helps lay out the needs for innovative ideas in a non-emotional way. Plus, doing so makes you a credible resource.

A recent study of large employers by the National Business Group on Health (NBGH) uncovered key things employers want to give their employees this year. The study noted:

“Employers are rethinking consumerism. Today’s consumer places a premium on simplicity, convenience, and personalization. Navigators, concierge services and virtual resources are expanding to help consumers take some of the complexity out of accessing care and to better anticipate and address their unique needs.”

freshbenies TIP #2! Navigators and concierge services are quickly becoming a requirement among employers. Customer service from the medical plan is no longer good enough. People want and need independent, expert advocates to help them navigate all aspects of their benefits plan and the health care system. Click the image below for a webinar we recently produced that outlines a detailed summary of services employers want to provide employees. This service really rounds out a premium benefit plan - AND it’s included in many freshbenies package options.

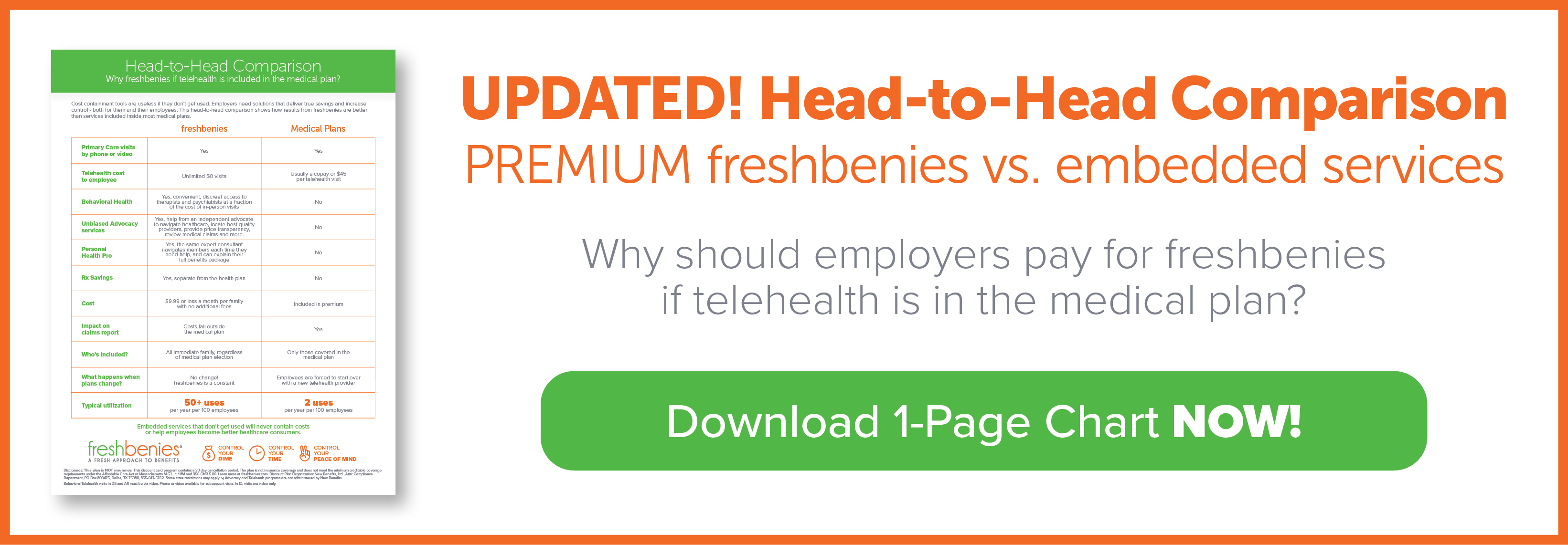

freshbenies TIP #3! From the study, virtual resources refers to healthcare tools like telehealth primary care and specialist visits by email, phone or video. But it also means they must be delivered in a way that maximizes employee engagement. Versions of telehealth embedded in a medical plan don’t get used, so they don’t really count as a resource. You can leverage that known failure and the NBGH survey to explain the need for a complete program. freshbenies’ turnkey member engagement system drives market-leading utilization rather than just 1 to 7% usage elsewhere. A suite of services that gets used saves far more than it costs.

3. Offer more help with Rx costs

The NBGH study also states that 7 of every 10 employees “struggle with prescription drug costs.” High Rx inflation plays out in many ways...

- longer non-formulary lists

- increasing deductibles on prescriptions

- more top-tier drugs

Most employers are looking for every insurance and non-insurance solution you can bring to help with this.

Share your applicable insurance-based options during the mid-year review. There is a range of other non-insurance consumerism savings options outside of the plan can be helpful, but some are extremely cumbersome to roll out. Still, these other options are especially valuable when an employee’s out-of-pocket costs incentivize them to be better consumers.

freshbenies TIP #4! Below are a few ideas to bring...

- A savings program with an independent PBM can offer families discounts whether they have insurance or not - and sometimes the savings is better than insurance.

- An easy price transparency tool helps employees locate the best price for their prescription. The freshbenies app and portal helps members quickly search local and mail order pharmacies to save an average 79% on generic and 34% on brand name medications.

- That top-notch Advocacy service can help! Download this Advocacy Infographic and check out item #5 to see how. This is a great service to highlight to the employer.

4. Improve access to behavioral health

This week, a consultant at one of the largest brokerages in the country told me virtually every employer is asking her for alternative ways to address the behavioral health needs of their people.

This access-to-care challenge is mirrored in the NBGH survey and by the stat that 96.5 million Americans live in areas with a shortage of behavioral health providers.

Beyond just in-person access, cost and stigma are also huge barriers to behavioral health care.

- 1 month is the national average wait-time for an in-person behavioral health visit

- $201 billion is spent on behavioral health annually

- 53% of mental illnesses are misdiagnosed

- 50+% of behavioral health patients have a medical co-morbidity

All of the major telehealth vendors are expanding their list of providers to support phone or video behavioral health visits. Our experience has shown that by starting this conversation, employers with this concern identify their interest quickly. Click here for a one-pager with shareable stats on this topic.

freshbenies TIP #5! This need drove us to include freshbenies package options with Behavioral Telehealth.

- Virtual visits with psychologists, counselors, or therapists at a fraction of the cost of typical in-person visits

- Convenient and discreet sessions by phone or video

- Available nationwide, with a first visit available in just a week

- Family members are included!

5. Include something for the fave family members - PETS

Did you know 3 in 5 Americans have at least one pet in their home? Younger generations lead the rate of pet ownership with 71% among Millennials and 74% among Gen Xers. Loveable as they are, pets are a BIG expense.

Here’s a quick breakdown of the 2019 pet spend in four major categories…

- $36.9 billion for pet food and treats

- $29.3 billion for vet care and product sales

- $19.2 billion for purchasing live animals, supplies and over the counter medicine

- $10.3 billion for other services (boarding, grooming, training, pet sitting, etc.)

While pet insurance is expensive and can be a pain to implement, it's a win to find other low-cost, high-value opportunities to help employees save on these expenses.

freshbenies TIP #6! Our new Pet Pack includes Pet Telehealth plus savings on everyday pet needs. This service can be added to a core freshbenies membership OR offered as a stand-alone package. Get the deets here!

5.5 Listen

My bonus recommendation for your Mid-Year Client Reviews is get curious and take time to listen to what’s going on in their organization. In this meeting you have the time to make a friend, have a laugh, discover nuances about their home family and their work family. Along the way you’ll learn things that’ll lead you to offer more solutions and provide more help - and that gives you stickiness.

Now it’s your turn! What’s your best tip for mid-year reviews? What challenges do you have with these meetings? Comment below or email me at reid@freshbenies.com.