3 Lessons from EBN’s Benefits Forum & Expo

Late September in New Orleans, Employee Benefit Advisor (EBA) and Employee Benefit News (EBN) hosted their Benefits Forum & Expo. Because it’s virtually the last benefit conference of the year, it’s like the exclamation point on the benefits industry for 2018.

I attended and taught at more than 30 conferences this year. This particular one has a broader view than most because the attendance is split between benefits consultants and HR experts from mid-sized to large employers.

As I reviewed my notes this week, 3 key themes popped out…

1. Employers Are Still Searching

HR expert goals remain the same: attract and retain employees and keep them engaged while they’re employed. But it’s clear from the speakers and the audience that this is a moving target.

The opening panel noted that we are in an “employer-driven health care economy.” Since employers are funding most of this combustible healthcare system, they can’t wait around for outside influences to change. Rather, their cry was, “employers need to PUSH for change!” Click here to learn more.

Many of the HR experts explored how to deal with the modern workforce:

Compensation

Big news: employees want more pay. Sure. But new hotter trends focus on HOW to bonus and give increases. Specifically, some say we should remove annual performance reviews, remove annual merit-based increases, and even consider pay transparency! Click here to learn more.

Another hot trend is flexible work hours. According to a Gallup Poll, 51% of employees list this as more important than a pay raise. One of the most interesting references was a panel (including Renee Albert, Facebook’s Senior Director of Benefits) that discussed expanded paid leave policies – think ultimate flex-hours, sabbaticals, smoother transitions back to work after a loss, and premium caregiver support programs. Click here to learn more.

Leadership

One of my favorite quotes from the whole conference was, “Having a great boss is the #1 best employee benefit.” As the Gallup study confirmed, 1 out of 2 employees who quits a job does so to get away from a bad manager. Click here to learn more.

So, how should we manage today’s workforce? Tactics include: educate with formal classes, coach with weekly touch base meetings, and invest in employees as if they’ll stay for their whole career (because what if you don’t invest in them, and they decide to stay?). And employers need to brush up on their marketing skills to better communicate company values and employee benefits with: creativity, gamification, social media, bite-sized communications, and data analysis to track results.

Benefits

School loan reimbursement programs continue to be discussed with enthusiasm, although it feels like HR is waiting to get it organized in a tax-advantaged program. That doesn’t appear to be on the horizon. Click here to read successful case studies of self-administered programs.

Financial wellness is a real concern for employers: turns out people stressed with debt and a dark future aren’t as productive. But how do employers move the dial on getting people to change? That’s a different story. Discussions ranged from how to increase 401(k) contributions (learn more here), to how a well-designed app might truly help employees track their daily cash flow (click here for more about the Even app).

It’s amazing how taboo a subject behavioral health issues are inside most employers. Bell telecom spoke about five steps to increase engagement: ”Commitment and awareness, support services, mental health training, return to work and accommodation processes, and the ability to measure progress.” Click here to learn more.

Of course, I can’t write this recap article without mentioning the many references to telehealth. It was identified as a simple and discreet way to deliver behavioral health visits. Futurist Ian Morrison listed it as one of the cost containment tools that actually contains costs. But I was most surprised that while telehealth is more than a decade old, most vendors and large employers are just now starting to realize that it takes a concerted effort to get employees to use it (see discussion here). I felt a little vindicated, as high-usage has been the focus and main selling point of our freshbenies platform for years. Click here for an article from my talk at this same convention 3 years ago.

2. Everyone’s Still Asking “What Does the Future Hold?”

The opening keynote was by Morrison, the futurist and healthcare author / consultant. He started by identifying the current state of the industry in 2018:

- “Surveys show people now feel less secure with their insurance today, across all insurance types: individual and even employer-sponsored.”

- “Yes, the uninsured rate came down from 15% to 11% (although it’s now slightly higher than that). But subsidies have been the main reason for the reduction.”

- “Employers now pay just 56% of expected employee medical costs.”

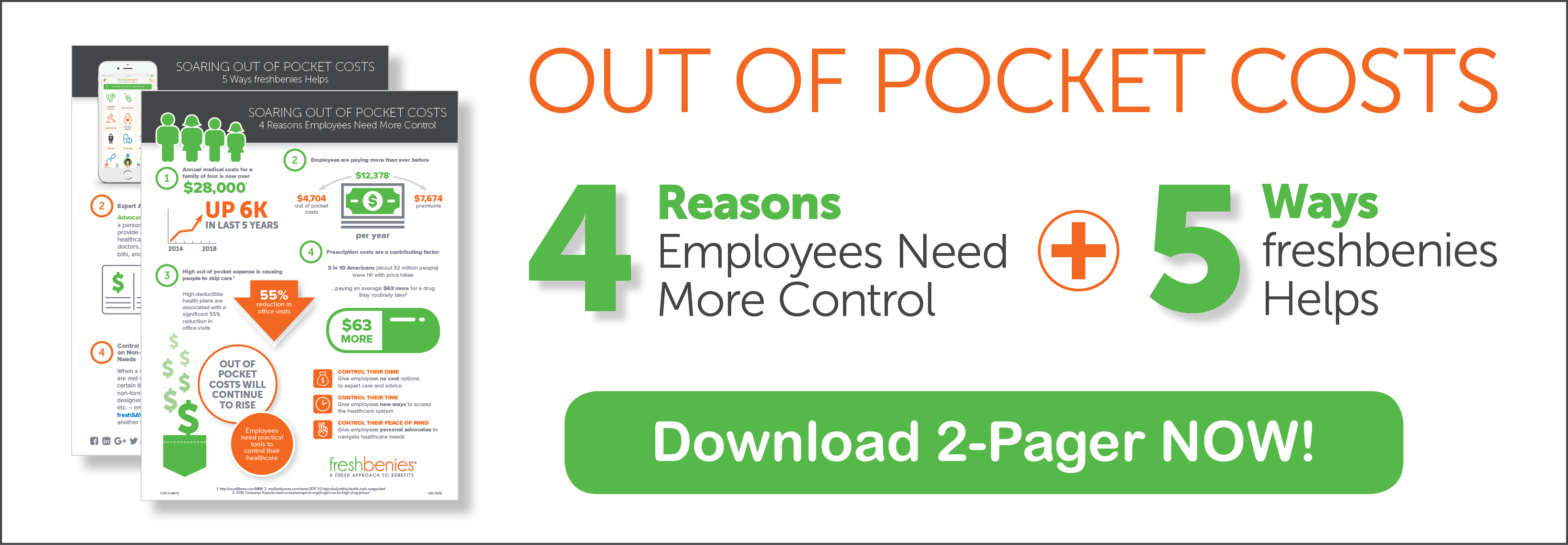

- “The relentless increase in out-of-pocket costs is upsetting people at all levels…”

- “… it’s what is pushing Democrats toward Medicare-For-All ideas.”

- And one of his most insightful comments that I’ve not heard expressed so eloquently: “‘Repeal & Replace’ was a SLOGAN without a POLICY. ‘Single Payer’ is the same.”

Which led into Morrison’s predictions of three possible scenarios that might play out in America:

- Medical Darwinism: Doctors walk away from the poor. We go back to the medical system being available only to those who can pay – and there are 50+ million uninsured.

- Single Payer: With a massive transfer of wealth from rich to poor, government would reduce the prices and incomes of all actors in healthcare. It would require changing the mix of care: with a dramatic reduction in the percentage of specialists. Morrison explained, “Americans are not Canadians.” As an ex-Canadian, I agree wholeheartedly with this!

- Integrated Care: A variety of models built around medical groups that focus on value, better coordination of care, and bundled pricing. Increased focus on population health, care targets tied to economic growth, and reducing the cost structure in health delivery.

In case you’re wondering, he’s hoping we choose bullet #3. Me, too.

3. Brokers / Consultants Say “Change or Quit”

Do you call yourself an Agent, Broker, Consultant, Benefits Advisor, Producer, Health Care Expert, “Insurance Pitchman” or something even less-known? It was up for debate! Click here to read more.

While 100% of consultants agreed that we need to change, we didn’t all agree on what aspects to change. Topics included:

- Change who you model yourself after: The Employee Benefit Advisers of the Year are a great place to start. Congrats David Sokol! Click here for the full list of winners.

- Change the way you approach and sell clients: Click here for a few ideas from those in the trenches.

- Change your proposed plan designs: Include Value Based Insurance Design (VBID) and Reference Based Pricing. Although the audience agreed, it’s not something to fight for on your own. The advice was to find someone you trust for guidance.

- Change your story: Whether it’s smarter rollouts of financial wellness (learn more here), saving huge dollars with dependent eligibility verifications (learn more here), or being the only advisor embracing Artificial Intelligence (shameless plug: I taught this class, but click here for a summary from EBA).

Now that we’re well into Q4, there are no more 2018 conferences. But don’t rest on your laurels. During your busy season, figure out how to improve your approach and your “value story” for 2019. Because your competitors are.

Are you ready to compete?

Comment below or email me at reid@freshbenies.com.