3 Reasons Health Plans Aren’t Enough & 3 Solutions

Brokers, do you consider only “traditional insurance products” worthy of your clients’ time, attention and budget? Most of the brokers I work with don’t think this way, but I’ve had conversations with older-thinking brokers boxed into the idea that any benefit outside of the health plan is something they don’t need to care about.

I absolutely understand the critical issues a health plan solves for employers. But, I also see the urgency to address growing issues those plans can’t solve. And let’s face it, employers gets calls all the time from other brokers wanting to discuss medical plans. Employers need to stand out against the competition – and so do you.

Today, let’s talk about 3 reasons non-insurance services like advocacy, telehealth, behavioral telehealth, savings networks, etc. can boost any benefits package and shouldn’t be ignored…

1. Health plans have holes

For years now, health plans have shifted more and more costs to employees. Higher deductibles and out of pocket maximums are the norm. On top of contributing more to premiums than ever before, employees are often stuck paying full price for care when…

- they haven’t hit their deductible

- they’re still under their out of pocket max

- they’ve exceeded the number of allowed visits for a particular service

SOLUTION #1: Non-insurance services give employees an opportunity to save when they find themselves in these situations. Even when your client offers a great health plan, there’s value in equipping employees to be better healthcare consumers – which leads me to the next point.

2. New tools teach consumerism habits

American consumers do comparison shopping for everything (well, almost)! Before buying a new TV, car, or house, they do research and negotiate the best deal possible at the time of purchase. But, when it comes to healthcare, most people believe whatever insurance covers is the best option.

How many employees realize that they could be paying $50 less for their monthly prescription just by purchasing across the street? Or that their MRI could cost hundreds to thousands less at a facility closer to their home? Do they know their in-network doctor might do procedures at an out of network hospital? Hello surprise medical bill!

SOLUTION #2: Empowering employees with tools to be better healthcare consumers changes their mindset – and their out of pocket costs along with expenses hitting the health plan. That’s a classic win-win.

Just this past week, one of my brokers with a group who’s had freshbenies for years experienced a shared win with their client. This group of 160 freshbenies members has shown such significant savings from freshbenies, that they are using those funds to invest in freshbenies for their other 615 employees. This is a perfect example of my next point….

3. A benefit for EVERYONE is a differentiator

When you consider the employee size of your groups, do you automatically narrow it to the benefits-eligible population, or even just the number that choose the health plan? What about groups with a considerable number of part-time employees, 1099 contractors, or employees who didn’t elect medical?

Any sales person or business owner knows it’s always easier and less expensive to sell more services to your current clients than to find new clients.

SOLUTION #3: These situations give you and the employer a terrific opportunity to offer benefits to everyone. Imagine giving all employees (and their families) expert healthcare services as often as needed at no additional cost…

- Telehealth visits by phone or video, 24/7/365

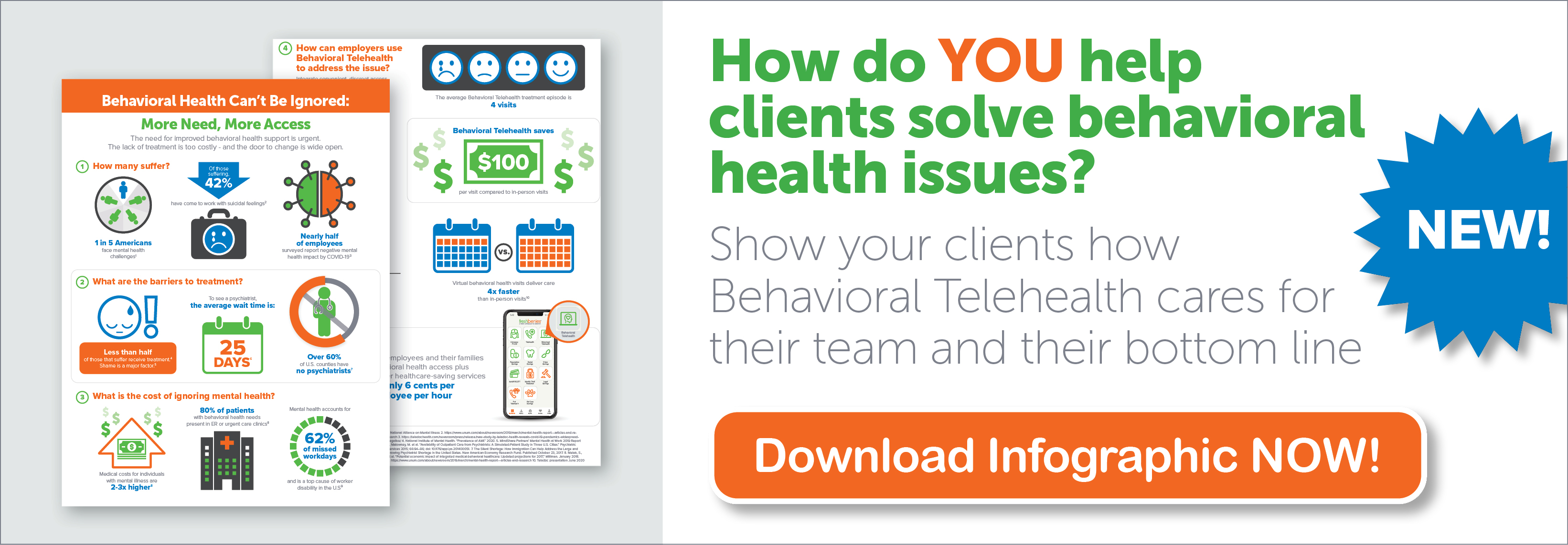

- Behavioral telehealth visits with therapists and psychiatrists by phone or video

- a personal healthcare pro to help navigate our complicated healthcare system – research medical pricing, find providers, negotiate bills

- savings networks for prescription, dental, vision and more

Whether employees are on the health plan or not, these tools fill a LOT of “cracks in the pavement.” Not only that, you’ve now become the person who brought a retention solution to help your client stand out in this tight labor market without a huge cost – positioning yourself as a strategic consultant.

These tools can help employees make smarter healthcare decisions and deliver ROI to your clients. Couple that with offering benefits to employees who wouldn’t normally have any and it’s clear that bringing non-insurance strategies to the table positions your clients and their employees for success.

Now it’s your turn! How do you bring value to the benefits package beyond the health plan for your groups? Comment below or email us at brokers@freshbenies.com.