Rethinking Employee Benefits: 4 Ideas

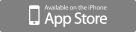

As a benefits consultant-advisor, you’ve probably spent a lot of time over the last 5 years rethinking benefit planning and your role with customers. Today's employee benefits plan includes solutions for many issues you never had to implement a few years ago: benefits administration, HR technology, payroll systems, compliance, etc. Determining appropriate cost containment strategies has been crucial as you discuss qualified high-deductible plans, deciding to self-fund (or not), increasing out-of-pocket costs, reducing networks, changing prescription formularies, etc. That’s quite a list, but still only the beginning. I don’t see any of that going away. In short, this ain’t your grandma’s benefits industry.

Through all these changes, how do we ensure the employee isn’t left behind? Have we given them tools to be better consumers and make healthier choices? How do we help employees be more productive? Have we offered solutions to give them a healthy environment from which to work? Have we supported employers in THEIR goals?

To help answer these questions, I believe there are 4 ideas that should be considered for every employee benefits plan:

4 Ideas for Every Employee Benefits Plan

1) Access to care

Smaller networks and the coming doctor shortage mean our clients have less access to care. Telehealth is a great way to give employees great care at a low cost, and there are other low cost-high value ways to help employees with medical issues, too.

We recently introduced a new service called Doctors Online. This gives employees and their families instant access by email to a full spectrum of specialists (physicians, psychologists, dietitians, fitness trainers, dentists, pharmacists, etc.). Members can ask any question and have them answered by a licensed U.S.-based physician (in 3 hours, on average) – they also have follow-up access to the responding physician throughout the medical episode. Employees no longer have to search the web and self-diagnose, which usually generates unnecessary concern and possibly even a quicker visit to a specialist (assuming a quick visit is even possible). An employee benefits plan should incorporate innovative ways to access care.

2) Consumerism Tools

As medical, dental, vision and prescription costs continue to skyrocket, employees also need consumerism tools. Incorporating new offerings into each employee benefits plan can better meet an employers needs. There are inexpensive advocacy and dental-vision or prescription savings plans to help employees navigate healthcare and save on common services for their families.

Advocacy services help employees find high-quality, lower cost medical care. Prescription savings plans give employees another choice in pricing for prescriptions that are expensive or not covered. Dental and Vision savings plans allow employees who have insurance to save on procedures that are not covered or over the out-of-pocket max.

These services pay for themselves many times over with the savings employees see.

3) Healthier Employees

This means more than a biometric screening once a year or health risk assessment completed online. Managing disease will not work in the long term because the diseases will keep coming. Consistent weekly education seminars that teach employees how to enjoy a healthier diet, learn about exercise and movement options, and manage stress are necessary for employees to change behavior. This information will help members prevent disease.

Does your agency provide this type of program? There is certainly a cost to it, but what a great service to be able to offer to interested customers. Even if you don’t include a Wellness Director on your staff, you could contract with a Health Coach for some clients and ensure their employee benefits plan includes education seminars.

4) Benefits Communication

Employers don’t have time to consistently communicate and educate employees on new benefits and tools. When you implement these types of benefits, it’s important the vendor has a clear communication strategy. Without that, employees will not understand or utilize the benefits. Surveys consistently tell us that employees want benefit communications throughout the year. Therefore, the communication strategy for every employee benefits plan should be consistent and should reach people in the various places they are, such as: monthly newsletters, a mobile app, an online member portal, videos and blogs. The content needs to be employee-friendly and simple. With better communication, employees will be empowered.

In the end, nothing is going to change about the cost of healthcare until we get the employees to understand and buy into the solutions. And it won’t happen overnight. Consistent messaging has to be included as a component for an employee benefits plan when new tools or benefits are offered.

Now it’s your turn! In what ways are you rethinking employee benefits and the services you offer? Comment below or email me at dan@freshbenies!