Medical Prices: Where They Come From & Why You Need Help

As someone in the employee benefits industry, you already know medical prices can vary wildly between healthcare providers for the same procedure, in the same network, and even within the same zip code.

In 2012, I read a story about a reporter who needed an MRI due to some migraine issues (spoiler alert: it hasn’t gotten any better since then). He decided he would take this opportunity to become “an engaged, savvy patient.” He called around to get pricing (which was difficult, to say the least) and found prices ranging from $600 to $7468.

In the past couple months, I’ve heard from multiple industry insiders who have been personally frustrated with “the system” in which we are required to operate.

Here’s one very good recap that Healthcare Purchasing Consultant, Joey Bickley, recently posted on LinkedIn…

“Spent the last 4 hours trying to get price estimates for upcoming tests and lab work my…doctor encouraged me to get... Over the years, I feel fortunate to have picked up several tools, tricks, tips and resources both as a consumer of Health Care and professionally as an advisor to help with quality, price & cost. Today however - I feel I’ve lost the battle. Tomorrow will be a new day. I’ll push forward to win the war to be better & learn more in order to help realize better experiences for myself and others I work with navigating the supply chain of Health Care and the Health Plans.

There is no “free market” in our current system. It’s very tiring (and costly) to navigate such a dysfunctional and inefficient system - fragmented care, no centralized health data storage, non-transparent pricing, network discounts that I can’t be told until after tests are performed, to just name a few.”

Why is it so difficult?

Well, I fancy myself as somewhat of a good communicator, so let’s see if I can simplify this overwhelming topic!

Unfortunately, pricing norms for most other products/services in the US are not the same for healthcare where products/services of similar quality are found at drastically different prices. To an outsider (like, 95% of Americans), there’s really no rhyme or reason. Why? I don’t have the space to list all the reasons, so I’ll shorten to say: a complex, layered system with many “fingers in the money pot.”

Unlike most industries, government spending has a HUGE impact on where healthcare pricing starts. In the U.S., EVERY medical procedure or service available (and there are thousands of them) starts with the Medicare price as a baseline. In other words, if someone on Medicare had the procedure, the baseline price is what Medicare would pay the provider.

Does this mean a Medicare patient is charged less than a non-Medicare patient? Yes! Those of us with regular insurance plans pay more to make up for lower prices paid by Medicare and Medicaid, and from uninsured people who don’t pay for services.

I think Dr. Eric Bricker does a great job of breaking this down in 4 minutes…

Medical procedures for the rest of us in this country are then priced relative to Medicare pricing. Insurance companies take the Medicare baseline price and work with every local provider (docs, imaging centers, etc.) to negotiate what they’ll pay for each of these procedures or services. Each procedure is given a code - there are about 13,000 different medical procedure codes.

Further, facility prices depend on a variety of contract methods, but in the end, the insurance company generally pays approximately 50% of billed charges. Making it even more complicated, these billed charges are highly variable from hospital to hospital for the same procedure.

Dr. Bricker breaks down this process in just 90 seconds…

So, thousands of procedures across thousands of providers. YIKES!

How does it work?

Now, let’s use a fake procedure to help explain how it works: the Browoscopy (just go with it). Keep in mind, I’m WAY oversimplifying the process – imagine this process times 13,000 procedure codes. Now you can stop wondering why it’s hard to find the “real price” you’ll pay.

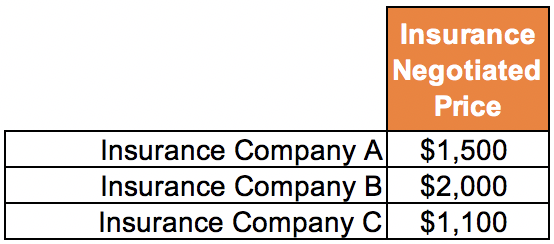

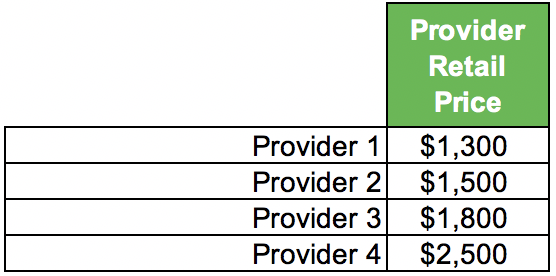

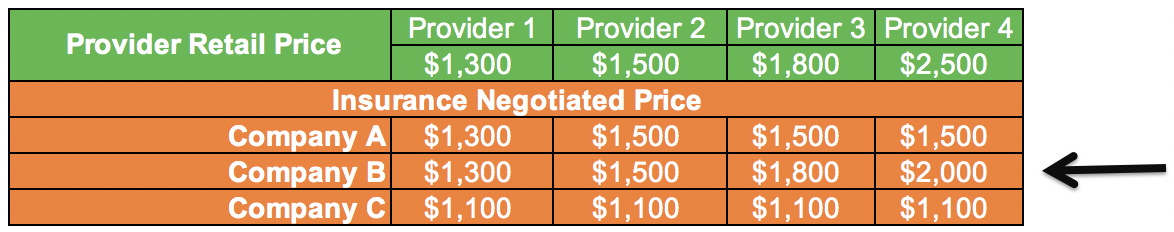

1. Insurance companies determine the price they'll pay for a Browoscopy.

2. The Providers determine what they’ll charge for the Browoscopy procedure (and all the other procedures they perform). Every provider has a “Retail” price and a “Negotiated” price with each individual insurance company. The Retail price is what they would charge patients (clients) who don’t have insurance or for those who are out-of-network. The Negotiated price is what they charge based on the insurance company’s negotiated amount.

3. Voila (but, not really)...your price is determined. After all this work is done, you pay the lower price between:

a. your insurance company’s Negotiated price

OR

b. the provider’s Retail price

What’s the problem?

There are many problems, but here are two…

Problem #1: If I were a savvy Browoscopy provider, I would charge a really high Retail price. This way, I would ALWAYS get paid the highest negotiated rate by all the insurance companies. This is why there is such a wide range of pricing. Like many industries in the US (hello, retail clothing), it’s a fake Retail amount because almost no one actually pays that price.

Problem #2: Using the example above, if I had a $5,000 deductible plan with Insurance Company B and I needed a Browoscopy, I would be very smart to shop around and go to Provider 1. I could save up to $700. If I didn’t shop around, I would be fine spending $2,000 at Provider 4 and think I got a deal through my insurance company’s negotiated rate (because I got a $500 discount).

What’s the REAL problem?

The REAL problem is that we tell people, “You just need to be a ‘better consumer.’ Be smarter about the provider you choose, and you can get a lower price. Do some research and find the best price.”

And let’s not forget about quality of care. In most industries, you expect that paying more will get you better quality. That’s not necessarily the case in healthcare.

We tell people to be better consumers, BUT we don’t give them the tools to help them. Have you ever tried to get a price on a simple medical procedure like an MRI or colonoscopy? It feels a little like being in a dream (nightmare) where you can’t find what you’re looking for and no one will help you.

Is there a solution?

Honestly, not entirely. However, as Americans are asked to take on more up-front costs, it’s even more important to equip them with the knowledge to efficiently use their benefits – to provide them with the tools they need to get the most value out of their dollars spent.

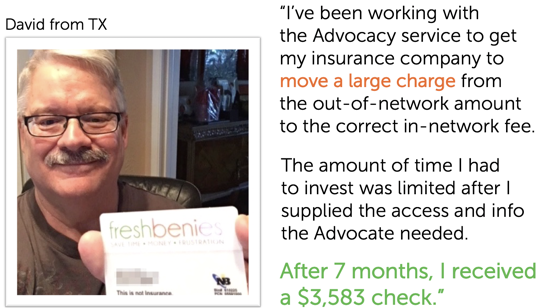

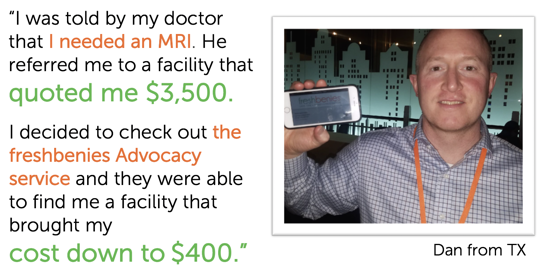

A strong Advocacy service can be a big help. Advocacy companies offer experts who are trained in the healthcare industry to personally guide people and help them navigate “the system.” See below for two real-life examples. In addition to price transparency, an Advocate can review and negotiate medical bills, locate in-network providers, review prescriptions for lower-cost options, and provide guidance to understand and use their benefits more efficiently.

However, an Advocacy program that people don’t use is about as effective as nothing at all. It’s important to choose a partner who engages employees and helps them understand their benefits.

The bottom line: medical pricing is complex and baffling to the trained AND untrained eye – and there’s no sign of change in the near future. It’s important to be on the look-out for practical tools that help people effectively navigate and control their healthcare.

Now, it’s your turn! Did you know this is how medical pricing worked? Do you have any questions? Feel free to post questions in the comments below or email me at heidi@freshbenies.com!